How to Invest in Solar Farms: Are They Worth the Investment?

Invest In Solar Farms

Investing in solar farms can be a lucrative option for those looking to support renewable energy and capitalize on growing market opportunities. By investing in solar farms, individuals can contribute to reducing carbon emissions and generating clean energy while also enjoying potential financial benefits.

Furthermore, with the solar farm investment tax credit, investors can receive a credit equal to a percentage % of their investment, which can help offset the initial costs and improve the overall return on investment.

However, like any investment, it’s important to thoroughly research and understand the potential risks and rewards of investing in solar farms. Factors such as location, size, and technology used can significantly impact the success of the investment.

Additionally, unforeseen circumstances such as natural disasters or changes in government policies can affect the profitability of solar farm investments. Therefore, it is crucial to carefully consider the potential for both investment loss and profit before committing to investing in solar farms.

- Solar energy has become most popular over the world in the last decade as solar panel prices have plummeted.

- Over the next few years, solar is expected to be a very expensive business.

- Several publicly traded companies are involved in the solar industry, ranging from PV production to panel installation.

Deeply Research on Solar Farm Business

Investing in solar farms presents promising opportunities for those looking to enter the renewable energy industry. However, before diving into this field, it is crucial to conduct deep and thorough research on solar farm business. Understanding the ins and outs of this industry is vital to make informed investment decisions and maximize returns.

One key aspect to focus on during the research phase is identifying the various solar farm investment opportunities available in the market. This involves studying the different types of solar farms such as utility-scale, community solar, or commercial solar projects. By exploring these options, investors can gain insights into the potential risks, returns, and operational requirements associated with each type of solar farm investment.

Additionally, delving into the dynamics of the solar energy market, including government incentives and regulations, will provide a comprehensive understanding of how to invest in solar energy effectively. With this thorough research, investors can pave the way for successful investment ventures in the solar farm business.

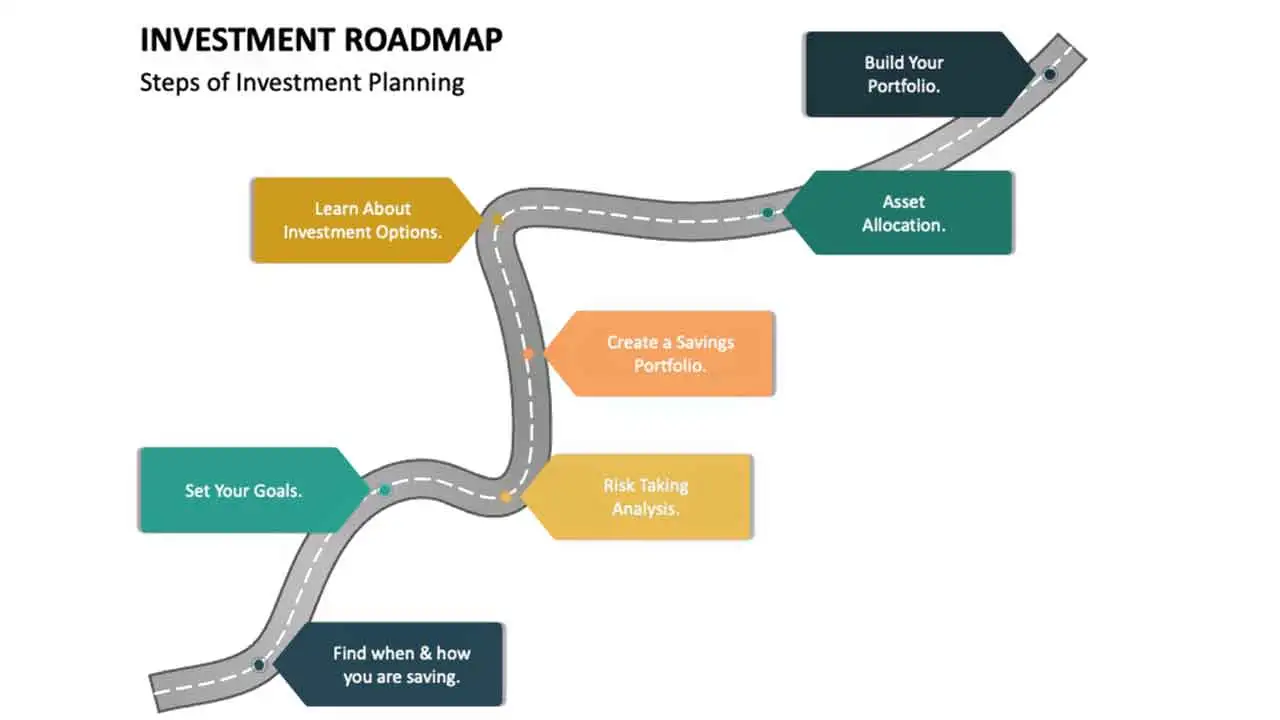

Road Map to Investment in Solar Forms

Investing in solar farms can be a lucrative opportunity for those seeking a sustainable and profitable investment. Before diving into this venture, it is important to understand the road map to investment in solar forms. To understand how to invest in solar, it is essential to have a comprehensive understanding of the solar energy industry.

Familiarize yourself with the different types of solar farms:

- Ground-mounted Solar

- Rooftop Solar

One crucial factor to consider is the solar farm return on investment (ROI), which indicates the profitability of the project. Calculating the ROI involves assessing the initial investment cost, operational expenses, and the potential revenue generated by the solar farm. Conducting thorough research and analysis to determine the expected ROI is crucial for making informed investment decisions.

Developing a proper approach to attract clients and ensuring all legal agreements are complied with is also vital in successfully investing in solar farms. Sourcing the best location for solar farms, considering factors like sunshine hours, grid connectivity, and land availability, is crucial for maximizing the project’s profitability. By following a well-defined road map, investors can navigate the complex terrain of solar farm investments and make informed decisions that align with their financial goals.

Compete Legal Agreements

In the realm of investing in solar projects and the solar farming business, it is imperative to navigate the landscape with caution and a clear understanding of the legalities involved. Before embarking on any investment endeavor, it is vital to thoroughly research and comprehend the complete legal agreements that govern the solar industry.

These agreements encompass a range of aspects, including project development, financing, operation, and maintenance. Understanding and complying with these legal agreements isn’t only a professional duty but also an essential step towards safeguarding your investments in the solar sector.

Moreover, when considering solar companies to invest in, it is crucial to scrutinize the legal agreements they have in place. These agreements govern the relationships between the company, its stakeholders, and potential investors. By carefully reviewing these agreements, investors can evaluate the risks associated with the company’s operations, financial stability, and potential legal liabilities.

Ensuring that these agreements are comprehensive, transparent, and in line with industry standards is essential for making informed investment decisions in the solar sector. By adhering to the guidelines and thoroughly examining the legal agreements, investors can mitigate risks and pave the way for a fruitful and successful solar investment journey.

Find the Best Location for Solar Forms

To maximize the potential of your investment in solar farms, finding the best location is crucial. Several factors must be taken into consideration to determine the feasibility and profitability of a location. Firstly, it is essential to conduct thorough research on the area’s solar resource availability.

The amount of sunlight received in a specific region will directly impact the efficiency and productivity of the solar panels. For instance, neo solar power corp, known for its extensive experience in the solar industry, emphasizes the significance of selecting locations with ample sunlight to optimize the energy output.

Small-Scale Solar Form: Additionally, assessing the proximity to the target market is vital. Consider locating your solar farm in regions with high energy demand and a supportive regulatory framework for renewable energy. Investing in solar gardens, which are smaller-scale solar farms that provide energy to a community or local area, can also be a strategic move. By catering to the local market, a solar garden can strengthen community ties, generate goodwill, and potentially increase revenue.

Large-Scale Solar Farm: Finding the best location for a solar farm requires careful consideration of the solar resource availability, proximity to the target market, and economic viability. By conducting thorough research and analysis, you can identify a location that optimizes energy output and ensures a profitable investment. Importantly, consulting with experts in the field, such as Neo Solar Power Corp, can provide valuable insights and guidance throughout the location selection process.

Cost Analysis: Moreover, evaluating the economic and financial aspects of a potential location is essential. Conduct a comprehensive analysis of the investment cost, potential revenue, and return on investment. It is imperative to determine whether a solar farm is a good investment for the specific location.

This evaluation should consider local market conditions, government incentives, and grants available. Understanding the regulatory landscape and any legal or licensing requirements is also crucial to ensure compliance and avoid future complications.

Start Work on your Industry

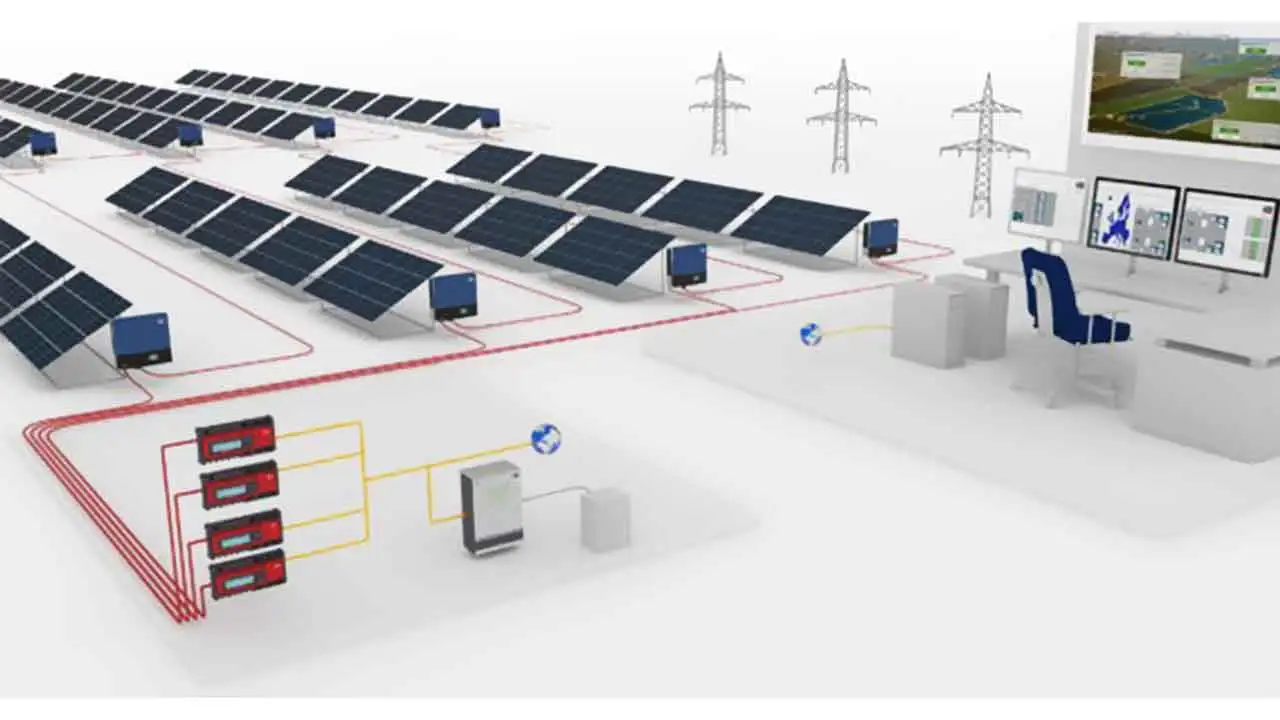

Once you have carefully researched and planned your investment in solar farms, it is time to start work on your industry. This step involves finding skilled solar farm contractors who have the expertise and experience to construct and maintain your solar farm. Hiring professionals ensures that the project is executed efficiently and up to industry standards.

One important consideration when starting work in your industry is assessing the profitability of solar farms. While solar energy is a rapidly growing industry, it is essential to evaluate the financial viability of your investment.

Factors such as government incentives, availability of sun exposure, and proximity to electricity grids can impact the profitability of solar farms. Conduct a thorough analysis of the potential returns using financial models and projections specifically tailored to solar farm investments. For instance, consider the case of the Big Plain Solar Farm, which has proven to be a highly profitable venture due to its strategic location and competitive energy production capacity.

Cost to Build a Solar Farm

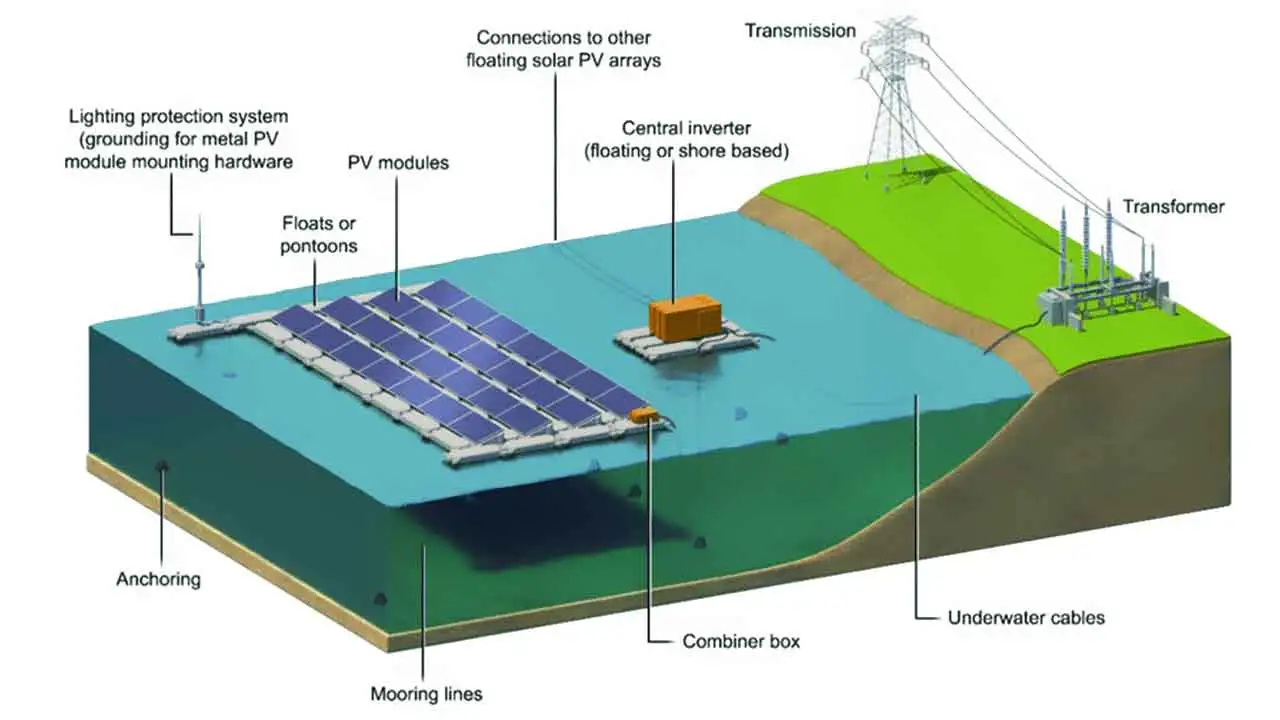

Building a solar farm involves substantial investment and careful consideration of various financial factors. The cost to build a solar farm can vary significantly depending on the size, location, and technology used. Typically, the primary costs associated with constructing solar power fields include land acquisition, equipment installation, and electrical infrastructure development.

Land acquisition often represents a significant portion of the total cost, as solar farms require vast expanses of land to accommodate the large number of solar panels. Additionally, the cost of solar energy stock and other necessary equipment such as inverters, cables, and mounting structures should be considered.

Furthermore, the development of electrical infrastructure, including transformers, switchgear, and transmission lines, adds to the overall expenses. It is also important to note that solar farms may require ongoing payment to the landowner, although the specific arrangements may vary. Understanding what solar farms pay the landowner is crucial to ensuring a comprehensive financial plan for the project.

Proper Approach to Clients

When it comes to the proper approach to clients in the solar power industry, it is crucial to establish trust and transparency from the very beginning. Clients who are considering investing in a solar power station or planning to build a solar farm require reliable and accurate information regarding the costs and benefits associated with these ventures.

As a professional in the field, it is essential to provide clients with comprehensive details about the solar farm cost, including the expenses related to equipment, installation, maintenance, and any other relevant factors. By offering a clear understanding of the financial aspects involved in establishing a solar power plant, you can help clients make informed decisions and build a strong business relationship based on trust and credibility.

Solar Forms Advantages and Disadvantages

| Advantages | Disadvantage |

| Electricity bill Controlled | Depend on Weather |

| Lowest Maintenance cost | Solar Energy Storage Plant Expensive |

| Technology Improvement | Use a Lot of Lands |

| Renew Source of Electricity | Environment Pollution |

| Benefit your community | Difficult it’s Relocation System |

| Long-Term Electricity Saving | Recycling System is Limited |

| Electricity Independence | Solar System doesn’t work Everywhere |

Solar Farm Revenue From Investment

Investing in solar farms can be a lucrative venture for those looking to capitalize on the growing demand for renewable energy sources. If you’re wondering how to invest in solar, there are several options available. One option is to directly invest in solar farms, either by purchasing existing facilities or funding the development of new ones.

This can provide a steady stream of revenue through the generation and sale of solar energy. Another option is to invest in solar stocks, which represent shares in companies involved in the solar industry. This allows investors to benefit from the overall growth and success of the sector.

When considering the potential revenue from a solar farm investment, it is important to understand the cost of building and operating such a facility. The cost of a 1 MW solar farm in Australia, for example, can vary depending on several factors including location, technology used, and installation costs. On average, it can range from AUD 1.2$ million to AUD 1.8$ million. However, with government incentives and economies of scale, it is possible to achieve a return on investment within a reasonable timeframe.

As for the prospects of solar energy, the outlook appears promising. With increasing global awareness about climate change and the need for clean energy sources, solar power is expected to continue its growth trajectory. The falling costs of solar panels and advancements in technology further contribute to its appeal. Moreover, many countries have committed to transitioning to renewable energy sources and have set ambitious targets for solar energy production. Therefore, investing in solar farms can not only provide a stable source of revenue but also contribute to a sustainable future.

Large-scale Solar Technology Work

Solar energy has emerged as a promising alternative to traditional sources of power, with a significant focus on large-scale solar technology work. However, recent market trends have raised concerns about solar stocks falling. Investors, who were once bullish on solar, are now questioning the long-term sustainability of this sector.

The primary reason behind the decline in solar stocks is the increasing competition from other renewable energy sources such as wind and hydroelectric power. The race to develop more efficient and cost-effective solar technologies has intensified, forcing solar companies to face tough challenges in maintaining their market share.

While solar energy offers numerous advantages, it is important to consider its disadvantages as well. Understanding the potential drawbacks can help investors make informed decisions. Some of the key disadvantages of solar energy include its intermittent nature, dependency on weather conditions, and high upfront costs.

Solar Farms vs Solar Stocks

As the demand for renewable energy sources continues to grow, investors are presented with the opportunity to benefit from the solar industry. 2 popular options for investing in solar energy are solar farms and solar stocks. While both provide avenues for financial growth, they differ in terms of their associated risks and rewards.

Solar farms offer a tangible investment opportunity, as they involve the acquisition and development of physical land and infrastructure for generating solar power. By harnessing the sun’s energy through the newest technology in solar panels, these farms can generate substantial electricity and revenue.

The advantages of investing in solar farms include stable and predictable long-term income streams, as well as the opportunity to contribute to sustainable development. However, this form of investment requires substantial capital and entails operational and maintenance costs. Additionally, determining the optimal location for a solar farm is critical to ensure maximum energy capture and profitability.

Solar Companies to Investment and Power

| Company Name | Market Capitalization | Highlights | Trailing P/E Ratio | Revenue Growth (%) |

| Daqo New Energy Corp. | 3.3 | Daqo is a Chinese solar energy company that manufactures polysilicon for sale to manufacturers of solar cells and modules. The company also builds photovoltaic wafers. | 1.8 | 45 |

| Brookfield Renewable Corp | 5.8 | One of the world’s biggest publicly traded pure-play renewable energy companies | 3.9 | 40 |

| Canadian Solar Inc. | 2.5 | Canadian Solar designs, builds and sells solar equipment for residential, commercial, and industrial customers. | 11.1 | 36 |

| First Solar Inc | 21.3 | Provides photovoltaic (PV) solar energy products globally. | 69.0 | 33 |

| Array Technologies Inc. | 3.2 | Specializes in solar tracking systems for utility-scale projects | -7.1 | 35 |

| Shoals Technologies Group Inc. | 3.5 | Provides electrical balance of systems (eBoS) products for solar energy projects. | -17.5 | 37 |

Future Benefits of Solar Panels

The future benefits of solar panels are far-reaching and have the potential to revolutionize the way we harness and consume energy. With advancements in technology and increasing efficiency, solar panels are expected to become even more affordable and widely accessible in the coming years. This will not only lead to reduced dependence on traditional energy sources but also significantly lower utility bills for both residential and commercial consumers.

Additionally, the adoption of solar panels on a large scale will contribute to a cleaner and more sustainable environment, as the use of renewable energy sources helps to combat climate change and reduce carbon emissions. In essence, the future of solar panels presents a promising outlook for a more cost-effective, environmentally friendly, and energy-independent future.

Furthermore, the future benefits of solar panels extend beyond just energy savings. As the demand for clean energy continues to rise, the solar industry is poised for massive growth and job creation. This means that investing in solar panels now can provide lucrative opportunities for individuals and businesses alike. Moreover, countries and governments worldwide are increasingly prioritizing renewable energy solutions, offering attractive financial incentives and tax credits to support the adoption of solar panels.

These incentives, coupled with the long-term cost savings and environmental benefits, make solar panels a compelling investment for the future. By embracing solar panel technology, individuals and organizations can not only contribute to a more sustainable future but also position themselves for financial gains and market competitiveness in the green energy sector.

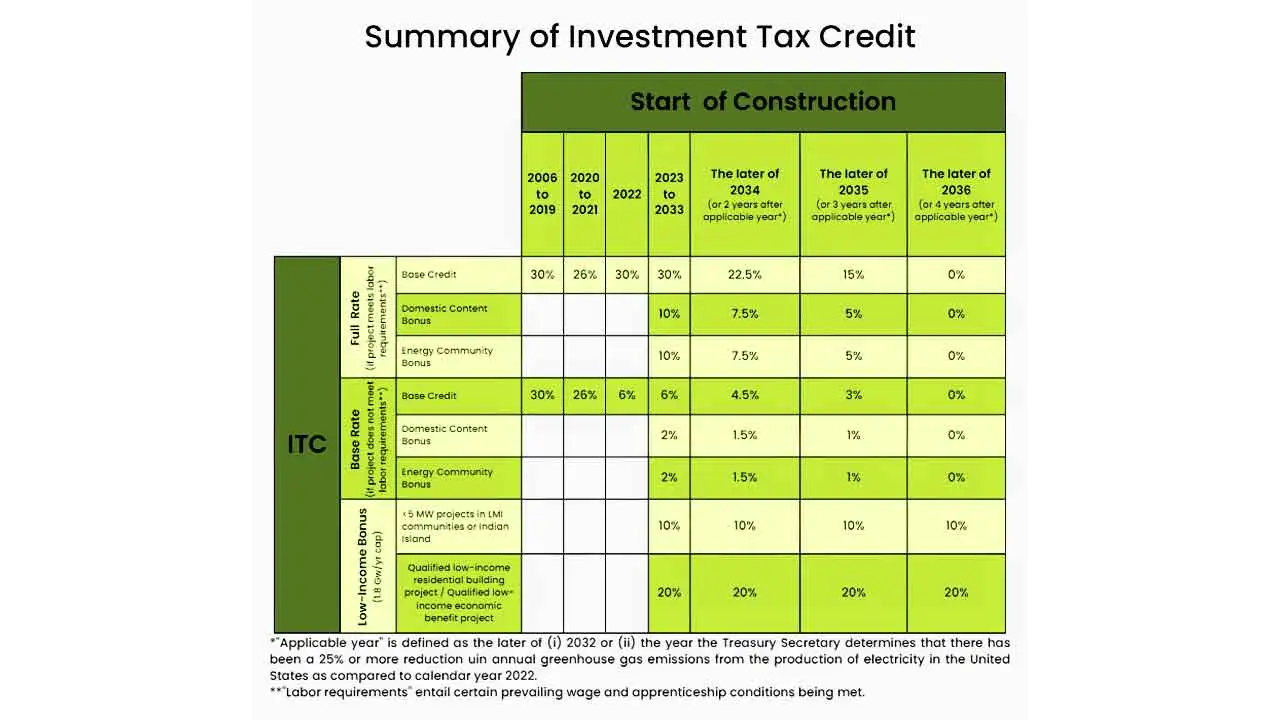

Summary of Investment of Solar Energy Tax Credit

The investment of the Solar Energy Tax Credit can prove to be extremely beneficial for individuals and businesses looking to venture into the solar energy industry. This tax credit allows investors to claim a percentage of their investment in solar energy systems as a credit on their federal taxes. It not only encourages the use of renewable energy but also provides a significant financial incentive to invest in solar farms.

Investors can take advantage of the Solar Investment Tax Credit (ITC) which provides a credit of up to 26% of the eligible costs for solar energy property. This tax credit is available for both residential and commercial projects, making it accessible to a wide range of investors. With the increasing demand for clean and sustainable energy sources, investing in solar farms can not only contribute to a greener future but also offer long-term economic benefits. By maximizing the potential of the Solar Energy Tax Credit, investors can make a positive impact on the environment while also enjoying substantial financial returns.