Advisory Shares Explained: What startups A Complete Guides Step-by-Step

Explain Advisory Shares

Advisory shares, also referred to as advisor shares, are a type of equity ownership in a company that is granted to individuals who provide expert guidance and advice. These shares aren’t the same as traditional stock options or restricted stock agreements, as they don’t provide voting or ownership rights. Instead, advisory shares are often used as a means of compensating advisors for their time, knowledge, and expertise.

One key aspect that sets advisory shares apart is their purpose. While traditional equity options focus on providing ownership stakes to employees as a form of incentive, advisory shares primarily grant a percentage of equity to advisors as compensation for their advisory role.

The goal is to align the interests of the advisors with the company’s success, as their equity percentage gives them a vested interest in seeing the company prosper. This arrangement encourages advisors to actively contribute their expertise and work towards the company’s growth and profitability.

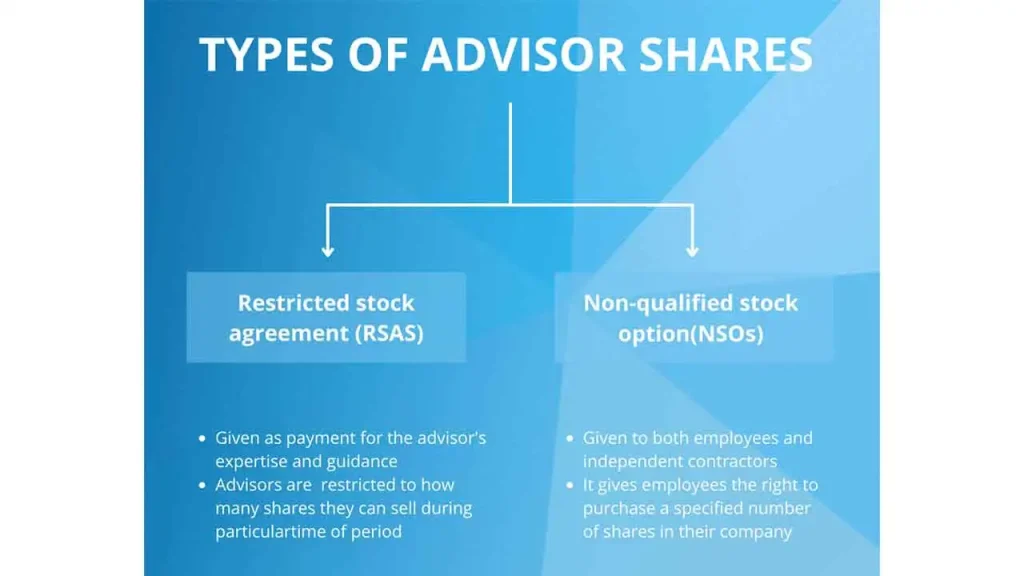

Types of Advisory Shares

Non-Qualified Stock Options (NSOs) and Restricted Stock Agreements (RSAs) are the 2 main types of advisory shares commonly used in businesses. NSOs provide the holder with the option to purchase company stocks at a predetermined price, known as the strike price. This type of advisory share is often used as a compensation incentive for employees or consultants.

On the other hand, RSAs are actual stocks granted to the advisor that are subject to various restrictions and conditions. These may include vesting schedules and performance criteria that must be met before the shares can be fully owned by the advisor.

When thinking about advisory shares, one might wonder: what exactly is an advisory share on Shark Tank? The popular TV show features entrepreneurs seeking investments. In some cases, the sharks may offer advisory shares to the entrepreneurs instead of investing money directly. This means that the sharks become advisors to the entrepreneurs, sharing their expertise and connections in exchange for a portion of ownership in the company.

Advisory shares are also prevalent in startup companies, where a technical advisor may be brought on board to provide specialized expertise in a specific field. The advisor may be compensated with advisory shares, aligning their interests with the success of the company’s growth. This arrangement ensures that the advisor has a stake in the company’s success and is motivated to contribute their skills and knowledge to help achieve the company’s goals.

1 – Non-Qualified Stock Options (NSOs)

Non-Qualified Stock Options (NSOs) are a common component of the typical startup equity structure. These options provide employees and advisors with the right to purchase company stock at a predetermined price, known as the exercise price. NSOs offer flexibility in terms of granting to both employees and non-employee advisors, such as consultants or board members.

In addition to employees and advisors, stock options advisory services can assist individuals in understanding the complexities of NSOs and help navigate the best strategies for exercising them. Engaging with a reputable stock options advisory service can be beneficial for maximizing the potential value of NSOs.

When considering NSOs, it’s important for both employees and advisors to fully understand the terms and conditions of these stock options. This includes the exercise price, vesting schedule, and any additional restrictions or limitations that may be associated with the options.

It is also crucial to seek guidance from a stock options advisory service to ensure a comprehensive understanding of NSOs and to determine the best course of action for each individual. With the help of the best stock options advisory service, employees and advisors can make informed decisions regarding the exercise and sale of their NSOs while taking into account various tax implications and potential risks.

2 – Restricted Stock Agreements (RSAs)

Restricted Stock Agreements (RSAs) are another type of advisory shares that companies may issue to their advisors. Unlike non-qualified stock options (NSOs), RSAs provide the advisor with actual ownership of company stock at the time of grant, rather than the right to purchase shares in the future. This means that the advisor becomes a shareholder and has all the rights and privileges that come with it, such as voting rights and the potential for dividends.

An example of how RSAs work is when a startup company brings on a seasoned industry expert as an advisor. In exchange for their guidance and expertise, the company may grant the advisor RSAs equal to a certain percentage of the company’s overall equity. This allows the advisor to share in the company’s success and potentially benefit financially if the company’s value increases over time. It’s important to note, however, that RSAs may be subject to vesting schedules and other restrictions, ensuring that the advisor remains engaged and committed to the company’s long-term success.

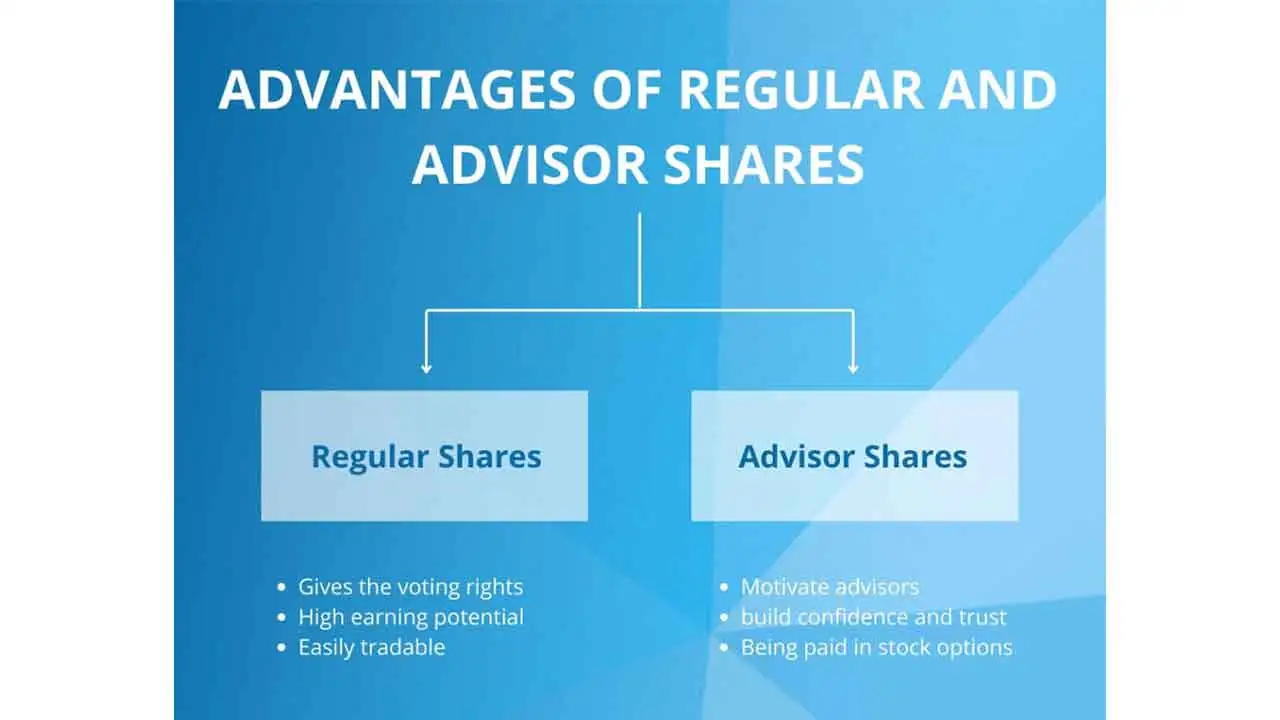

Advisory Share vs Regular Shares

What’s the difference between advisory shares and regular shares? Advisory shares are specifically issued to individuals who provide advisory or consulting services to a company. These shares typically come with certain terms and conditions that are unique to the advisory relationship.

On the other hand, regular shares are the ownership stakes that investors, founders, and employees hold in a company. They are typically issued as part of a fundraising round, compensation package, or equity incentive plan.

In popular television shows like Shark Tank, advisory shares play an important role in the negotiation process. Entrepreneurs who pitch their business ideas often seek investment and advice from the panel of “sharks.” A typical scenario involves the entrepreneur offering a percentage of their business in exchange for the expertise and connections that the shark can provide.

ISO Vs NSO Split

The ISO/NSO split refers to the distribution of advisory shares between non-qualified stock options (NSOs) and incentive stock options (ISOs). NSOs are a type of advisory share that allows the holder to purchase company stock at a predetermined price. ISOs, on the other hand, have certain tax advantages and are subject to specific requirements.

When it comes to advisory shares, the ISO/NSO split is an important consideration. It determines how the shares will be allocated and the potential tax implications for the holder. For example, a 5% ISO/NSO split means that out of the total advisory shares granted, 5% will consist of ISOs while the remaining 95% will be NSOs. This split can have an impact on the overall value and potential tax liabilities of the shares.

Understanding the different types of advisory shares is essential for investors and entrepreneurs. By exploring options such as NSOs and ISOs, individuals can make informed decisions about their investment strategies and potential benefits. Both types of advisory shares have their advantages and disadvantages, and it is vital to assess the specific needs and goals before deciding on the right approach.

Sign Agreement of Advisory Shares

When it comes to signing the agreement for advisory shares, there are some important factors to consider.

- Firstly, it’s essential to understand how these shares are issued. Unlike traditional equity shares, advisory shares are typically granted to advisors or consultants who provide valuable guidance and expertise to the company.

- Secondly, the terms and conditions of issuing advisory shares can vary, so it’s crucial to carefully review the agreement and ensure that both parties are in alignment regarding the expectations and benefits associated with these shares.

- Additionally, it’s important to note that advisory shares don’t typically entitle the holder to dividends. These shares are primarily focused on rewarding advisors for their valuable insights and contributions, rather than providing them with a direct stake in the company’s profits.

- One aspect to consider is the possibility of dilution for advisory shares. Dilution occurs when a company issues new shares, which can potentially reduce the value or percentage ownership of existing shares.

- Lastly, it’s crucial for advisors to carefully review the agreement to understand the potential impact of dilution and ensure an agreement that aligns with their interests and expectations.

Advisory Shares Many Plans

Advisory shares are an integral part of many investment plans, offering unique advantages and disadvantages for investors. Understanding the concept of advisory shares is essential for those looking to diversify their portfolios and seek expert guidance in managing their investments.

What is advisory in investing? Simply put, advisory shares provide investors with the opportunity to gain insights and recommendations from seasoned professionals who have extensive knowledge and experience in the financial markets. These advisors, also known as investment advisors or financial advisors, offer their expertise to individual investors or institutional clients.

While the guidance from advisors can be valuable, it comes at a cost. Investors must pay fees for the advisory services, which can eat into their investment returns over time. Additionally, relying solely on advisors may limit an investor’s ability to take control of their own investment decisions, potentially reducing the learning and growth opportunities that come with hands-on involvement in the investment process.

Advisory Shares in a Company

Advisory shares in a company provide a unique opportunity for individuals to contribute to the growth and development of a business. These shares are different from regular equity shares, as they don’t represent ownership in the company. Instead, advisory shares grant the holder the right to provide advice and expertise to the company in exchange for potential financial benefits.

How does advisory work, you may wonder? Well, individuals with advisory shares become valuable resources to the company, offering their industry knowledge, networks, and strategic insights to help the business make informed decisions and navigate challenges effectively.

Advisory Shares: Pros and Cons

Pros

Cons

Advisory Shares vs Equity

Advisory shares and equity are both forms of ownership in a company, but they operate differently and serve different purposes. Equity represents ownership in a company and typically comes in the form of stock or shares. This ownership entitles an individual to a percentage of the company’s profits, as well as voting rights in certain decisions. It is a more traditional and formal way of being a company owner, often obtained through employment or investment.

On the other hand, advisory shares are a non-traditional form of ownership that grants individuals the right to provide guidance and advice to a company without actually owning a share of its equity. These shares are commonly issued to advisors, consultants, or industry experts who can provide valuable insights and expertise to the company’s management.